Buying a house is the pinnacle of success—or, at least it used to be. It seems as though more and more people are abandoning the popular dream of homeownership and setting their sights on financial accomplishments that are more realistically attainable, like luxury vehicles, designer watches, and worldly travels.

That’s not to say purchasing a property is entirely off the table, though. There are plenty of affordable properties under 20k that you could buy without sending yourself into debt for several decades. There are two sides to every coin, but ultimately, there’s no single “correct” answer—it all comes down to your personal priorities. If you’re debating renting vs buying, consider these points to help you decide which option suits you best.

What’s on your time horizon?

If you’re thinking about buying a house, make sure to consider your timeline in two to 10 years from now. Will you be in the same city? Have the same job? Are you ready to settle down?

The people who like to rent are usually those that value flexibility and mobility; they don’t want to be tied down to a 15- or 30-year mortgage that locks them into one location. Of course, life happens and plans can always change, but if you have to sell your home shortly after buying it in order to move to a new city or place your child in a better school district, for example, you could lose money on your initial investment.

Bottom line: Purchasing a home is an investment in your future, but it’s a long play that will require you to live in the same place for at least two years. Just like any investment, there’s risk involved should the real estate market crash and you owe more on the property than what it’s worth.

How is your credit looking?

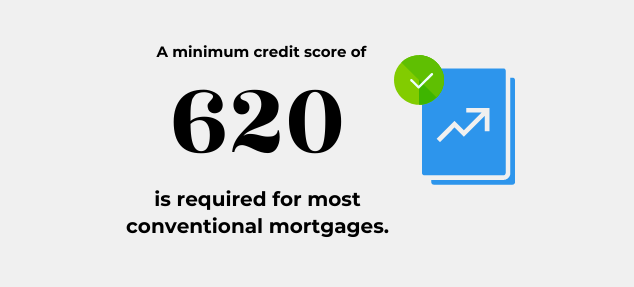

You’ll need a positive credit history whether you’re applying to rent or buy a house, but it’s much more important in the case of the latter. Most of the time, homeowners rely on financing to purchase a property; it’s pretty rare for someone to have a few hundred thousand sitting around in cash that they can use to complete the sale in one fell swoop.

Lenders will look at several things when reviewing your mortgage loan application, including your age and income, but credit history is one of the most important qualifiers. Not only do you need a strong credit score to finance a house, but it’s in your best interest to take the time to increase your score as high as possible in order to receive low rates.

A good number demonstrates less perceived risk, so the lender will be likelier to charge less interest on top of the principal balance—saving you a significant amount of money in total borrowing costs in the long run.

Bottom line: If you’ve missed a few bill payments in the past and are sitting on mismanaged debt, you should clean up your credit history before trying to buy a home.

Do you have money saved up?

One of the biggest differentiators between renters and buyers is the money they have saved up in the bank. Even with approved financing, you’ll need to place a sizable down payment—or, the portion of the purchase price that you pay upfront in cash—to show the lender you’re invested in the property and likely to repay the loan.

Many people think they need a down payment of at least 20% of the total price in order to buy a home, but that conventional wisdom doesn’t apply much today. While it’s true that a 20% down payment can help you avoid private mortgage insurance and save you tens of thousands of dollars in the long run, this barrier to entry is pretty steep for first-time buyers.

You can buy a home with anywhere between 5-15% down upfront, and there are also down payment assistance programs that can help you come up with the cash. Renting will also require a down payment, security deposit, and money on-hand for application fees, but these costs are usually cheaper than a mortgage and its affiliated costs.

What many people fail to realize, though, is that every rent payment they make likely goes toward paying off the landlord’s mortgage, and the price comparison isn’t that far apart. For example, if rent costs a thousand per month, a mortgage payment might be only 15% more. Rather than throwing that money down the drain on rent, those funds could be better applied to building your own wealth in home equity and increasing your net worth. You could also look into rent-to-buy homes in your area that can help you achieve the best of both worlds.

Bottom line: You’ll need to budget and save up for a home, which often leads people to stick with rent that’s easier to afford while keeping up with the cost of living—but putting in the work can pay off tenfold if you apply the cost of rent toward a tangible asset that you eventually own over time.

Are you financially responsible?

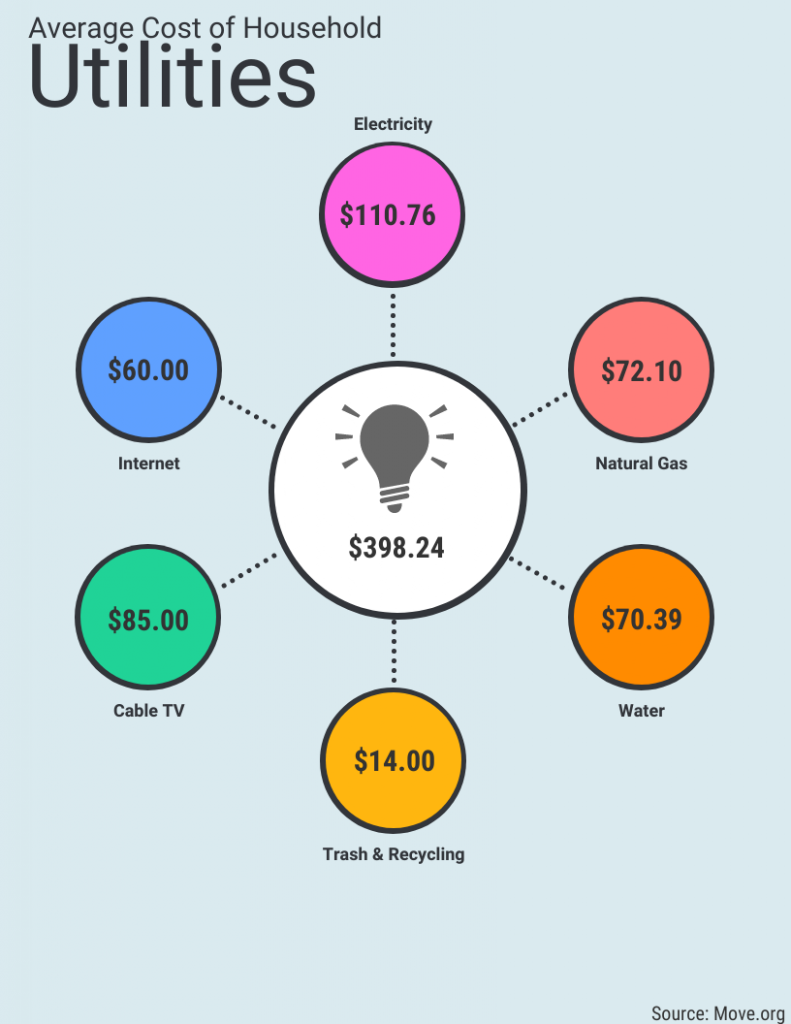

When you buy a home, the hard work doesn’t end once you get the keys in your hand. There are a lot of ongoing costs that you’ll need to keep up with, such as property taxes and maintenance repairs. And, whereas a renter could simply call up the property manager to fix a leaking sink, that responsibility will fall on you to repair yourself—unless you prefer to pay someone to do it for you.

Bottom line: If you don’t want to deal with the hassle of property maintenance and the ongoing costs of homeownership, it might be better to rent so you know exactly how much money to budget every month.

Do you have competing goals?

Finally, check in with your financial goals to see if there are competing priorities. Let’s say you just graduated from college; would you rather pay off your student loans or invest in the real estate market? Do you need a down payment to purchase a new vehicle?

Bottom line: It can be challenging to pay off debt or save money when owning a home, so consider your financial goals and decide what to accomplish first.

By keeping these thoughts in mind as you compare renting vs buying, you’ll be more likely to make the right decision for your financial future.

Samantha Rupp

Samantha Rupp holds a Bachelor of Science in Business Administration and is the managing editor for 365businesstips.com. She lives in San Diego, California and enjoys spending time on the beach, reading up on current industry trends, and traveling.